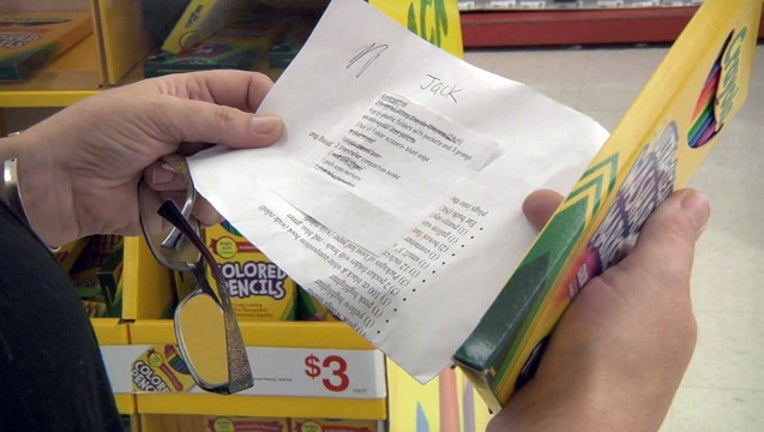

Back-to-school shopping tips and tricks

TAMPA (FOX 13) - Skipping the sales tax for back-to-school shopping sounds great, but some research has shown that prices can actually go up during the tax-free weekend.

The Tax Foundation, an independent tax policy nonprofit that's been operating since 1937, studied the effectiveness of these sales tax holidays. They say consumers can be misled because many retailers respond to the rush by raising prices to avoid running out of stock.

Not all stores do this by any means -- it's just a trend to keep in mind before you go to all the trouble of battling the crowds.

LINK: Read their 2016 report

And if you choose to shop online to avoid that mess, you’ll still want to shop around. A study by Wikibuy found that if you only back to school shop on Amazon, you wind up spending 15 percent more than if you shop on various sites. That’s in large part because Amazon's prices fluctuate so much over the course of a day.

They also found that prices for back-to-school items tended to drop later in the day, so the time of day you shop online could make a difference in what you pay as well.

LINK: Read the full report from Wikibuy

Deloitte Consulting did their annual survey and found the average family spends just over $500 on back-to-school shopping, so you're looking at saving around $30 - depending what you buy if you choose to shop tax-free.

But remember, there are stipulations. For example, with school supplies, it’s items $15 or less. Then with clothing, footwear, and accessories, $60 or less.

Personal computers and certain related accessories only qualify if they are $750 or less.

Meanwhile, some websites, including Target and Walmart, are trying to make things easier by allowing teachers to upload their lists, just like a shower registry. You can type in the school and the class and literally click "buy now" and save yourself the trip.