Manchin aims to restrict child tax credit eligibility in Build Back Better

The monthly child tax credit had the effect of reducing child poverty, but the advance monthly payments that Americans received in 2021 may not continue into this year. (iStock)

Millions of American families didn't receive a child tax credit (CTC) payment this month for the first time since July, after Congress failed to pass the Build Back Better Act. President Joe Biden's signature spending bill, which would have extended the expanded CTC through 2022, struggles to gain the support of moderate Sen. Joe Manchin, D-W.Va.

Build Back Better needs the support of every Democrat in a narrowly-divided Senate. However, Manchin has previously said that he won't back the bill unless lawmakers add a work requirement for CTC beneficiaries. This would mean that many families who received the expanded CTC in 2021 would no longer qualify for benefits.

Keep reading to learn more about the future of the CTC in 2022, including ways for parents to cut expenses as monthly payments expire. You can also visit Credible to compare offers on a number of financial products, such as debt consolidation loans and high-yield savings accounts, for free without impacting your credit score.

ACA CALL CENTER WORKERS CAN BARELY AFFORD THEIR OWN HEALTH CARE

Manchin won't support CTC without work requirement

The American Rescue Plan, which Biden signed into law in March 2021, increased the maximum child tax credit amount from $2,000 to $3,600 per child ages 5 and under and $3,000 for those between the ages of 6 and 17.

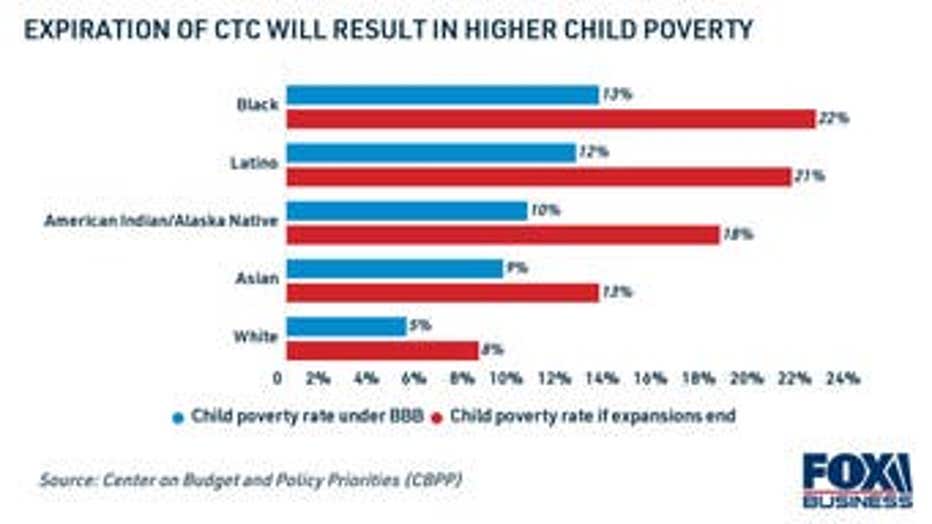

Extending the enhanced child tax credit through Build Back Better would potentially reduce childhood poverty by about 40%, according to research from the Center on Budget and Policy Priorities (CBPP). As the Senate struggles to pass the Build Back Better spending bill and the CTC expires, childhood poverty rates are expected to increase.

Child poverty would increase as child tax credits lapse in 2022, the CBPP said.

Congress has struggled to pass Build Back Better without Manchin's support. He has previously said he won't support the bill without adding a work requirement for CTC beneficiaries.

"I believe government should be your best partner, but it shouldn’t be your provider," Manchin told reporters in November. "We have a moral obligation to provide for those who have incapacities, such as physical or mental. But everyone else should be able to help and chip in, so that’s my mindset."

Manchin reiterated his stance on a work requirement to Business Insider in early January. But the Democratic Joint Economic Committee said that "imposing new restrictions would cut off vulnerable families, raise childhood poverty and increase racial disparities, hurting the children most in need of support."

Some progressive lawmakers have also come out against implementing a work requirement for families to receive the CTC advance payments.

"Children still need to eat — whether their parents are employed or not," Rep. Pramila Jayapal, D-Wash., said on Twitter.

One way for parents to prepare for unexpected expenses as CTC payments expire is to build a robust emergency fund that can cover 3 to 6 months' worth of expenses. You can grow your savings faster by setting up Direct Deposit from your paycheck into a high-yield savings account that grows with interest. You can compare high-yield savings accounts rates on Credible.

CHILD TAX CREDIT IMPROVES SAVINGS FOR 33% OF FAMILIES, DATA SHOWS

3 ways parents can cut expenses as CTC expires

As Build Back Better is stalled in the Senate, many families who received the monthly child tax credit payments in 2021 will need to find alternative ways to get by without this added benefit. Here are a few ways parents can save money as the CTC payments expire:

Read more about each strategy in the sections below.

1. Utilize current government benefits

Besides the child tax credit, there are several federal programs aimed at helping low-income families who need financial aid:

- Temporary Assistance for Needy Families (TANF) offers short-term financial assistance to help pay for child care and other expenses through state-administered programs.

- The Supplemental Nutritional Assistance Program (SNAP), also known as food stamps, provides financial aid to help eligible families buy groceries.

- Low-income families may qualify for housing vouchers, rental assistance and low-cost rentals through the Department of Housing (HUD).

Reach out to your local Department of Social Services to see if you qualify for any of these programs and apply for benefits.

HOW YOUR TAX REFUND CAN IMPROVE YOUR CREDIT

2. Find ways to reduce housing payments

Housing costs make up a significant portion of a family's household budget. If you're a homeowner, it may be possible to reduce your monthly mortgage payment by refinancing to a lower rate.

Mortgage rates reached historic lows in 2021, according to Freddie Mac. Although they've increased slightly since then, some homeowners may still be able to refinance to a lower interest rate. Refinancing your mortgage may help you save money on your monthly housing payment or pay off your home loan faster.

You can see if mortgage refinancing is right for you by checking your prequalified offers on Credible. Then, use a mortgage calculator to estimate your new monthly payments.

91% OF LOW-INCOME FAMILIES RELY ON CHILD TAX CREDIT TO COVER NECESSITIES

3. Pay off high-interest debt

Revolving credit card debt can be a burden on your personal finances, especially if you're only making the minimum payments on your credit card balances. Other high-interest debts, like payday loans, can trap consumers in a cycle of expensive debt that's difficult to repay.

If you're struggling with unmanageable debt, you could consider seeking help from a nonprofit credit counseling agency. A credit counselor may provide financial education, help you build a budget or set you up on a structured debt management plan (DMP). They may also be able to help you negotiate the amount you owe or help you get a lower interest rate on your current debt.

Well-qualified consumers with good credit may also qualify to pay off their credit cards at a lower interest rate with a debt consolidation loan. This is a type of personal loan that you repay in fixed monthly payments over a set period of time, typically a few years.

Since personal loan interest rates are currently at record lows, now may be a good time to save money on your monthly debt repayment with debt consolidation. Visit Credible to compare debt consolidation loan interest rates for free without impacting your credit score, so you can determine if this option is right for you.

DO COLLEGE STUDENTS NEED TO FILE TAXES?

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.