How to refinance student loans while interest rates are at record lows

Student loan refinancing can offer more favorable debt repayment options to help you save money on your student loan debt. (iStock)

Student loan refinancing allows borrowers to repay their college debt with better terms, such as a lower interest rate. This can make it possible to reduce monthly payments or pay off student loans faster, all while saving money over the life of the loan.

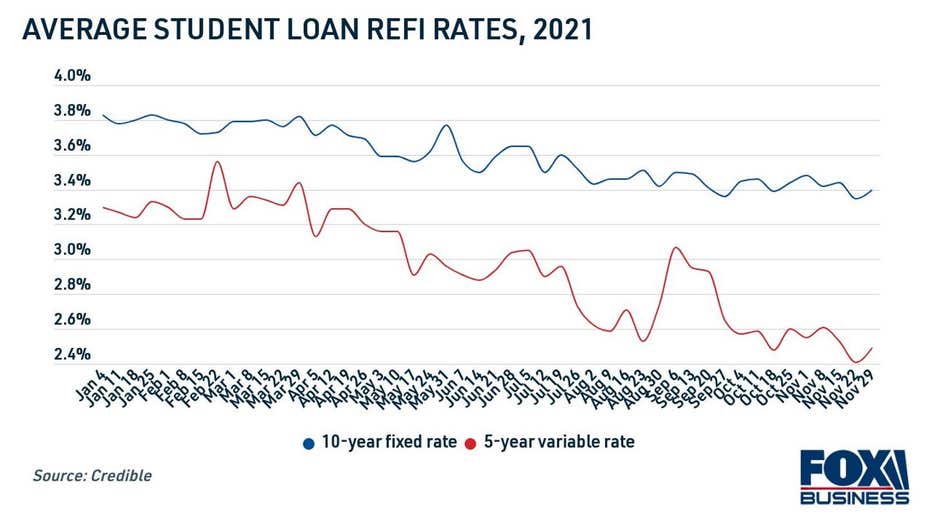

There's never been a better time to refinance student loans, since interest rates are setting record lows. Well-qualified borrowers who refinanced their student loans on Credible's online marketplace saw an average rate of 3.35% for the popular 10-year fixed-rate term during the week of Nov. 22. For the 5-year term, variable rates also fell to a new record low of 2.41% during that same time period.

SHOULD I REFINANCE MY FEDERAL STUDENT LOANS?

Although student loan refinance rates rose slightly for the week of Nov. 29, real borrowers are still taking advantage of historically low rates to refinance their debt for better terms. Keep reading to learn how to refinance your student loans in this low-rate environment, and browse student loan refi rates from real private lenders in the table below.

COMPARING PRIVATE STUDENT LOAN RATES CAN SAVE BORROWERS $5K+

Refinance your student loans in 5 easy steps

Student loan refinancing is a simple process that can be done completely online from the comfort of your own home. Here's how to refinance student loans in just five steps:

- Check your credit. Student loan refinance rates can vary based on a borrower's credit history, so get a free copy of your credit report through all three credit bureaus (Equifax, Experian and TransUnion) to see where you stand.

- Get prequalified through multiple lenders. Most student loan refinance lenders let you check your estimated interest rate and repayment terms with a soft credit inquiry, which won't affect your credit score. This lets you shop around for a lower rate than what you're currently paying.

- Choose the refinancing offer that works for you. Compare offers based on the loan length, monthly payments and interest rates. A longer loan term may offer lower monthly payments but costs more in the long run. Shorter-term loans let you pay off debt faster and save more money but may come with higher monthly payments.

- Formally apply for the refinancing loan. When you've chosen a student loan refinancing offer, you'll need to complete the application process through the lender. You'll need to gather your loan statements and other identifying documents, including proof of employment.

- Keep making payments while you wait for the loan disbursement. Within a few weeks of approval, your new lender will pay off your existing student loans. In the meantime, it's important to keep making student loan payments to avoid penalty APR and late fees.

When you're ready to view student loan refinance offers, visit Credible to get prequalified through multiple lenders at once. This allows you to compare repayment plans without checking your credit score, so you can choose the loan with the lowest interest rate possible for your situation.

HERE'S WHO HAS QUALIFIED FOR STUDENT LOAN FORGIVENESS UNDER BIDEN

How to lock in a lower student loan refinance rate

The goal of refinancing is to find a new loan with better terms than your current loan. But if you aren't able to qualify for the lowest rates available, then refinancing may not be worthwhile. Thankfully, it may be possible to improve your loan eligibility, so you can take advantage of record-low rates. Here's how:

- Work on building your credit score before you apply. The student loan refinance rates you're offered depend on several factors, including your credit history. You could consider improving your credit score before applying to lock in better offers with lower interest rates.

- Consider variable-rate student loan refinancing. While traditional fixed-rate loans let you lock in your rate for the entirety of the loan term, that's not the case with variable rates. Variable interest rate loans may offer better terms when you borrow the loan, but there's a chance that your interest rate may rise over time.

- Enlist the help of a creditworthy cosigner. A cosigner is a trusted friend or relative with good credit who agrees to apply for the loan with you to help you meet eligibility requirements. This can help you qualify for lower interest rates, but keep in mind that both parties will share responsibility for repaying the loan. If you miss a payment, your cosigner's credit score will take a hit, too.

BORROWERS BEGIN TO RECEIVE $2B WORTH OF STUDENT LOAN FORGIVENESS UNDER PSLF WAIVER

If you're still unsure if refinancing is right for you, use Credible's student loan refinancing calculator to estimate your new terms and potential savings over the life of your loan.

WHAT TO DO IF YOUR STUDENT LOAN SERVICER IS SHUTTING DOWN

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.