How has the pandemic impacted life insurance policies?

Getting life insurance during the pandemic

Jeff Rose, a certified financial planner, discusses life insurance -- Who needs it and should you get it during the pandemic? If so, how?

TAMPA, Fla. - The coronavirus pandemic has changed just about everything in our day to day lives. It has certainly changed how we look at life and plan for the future. This is especially true in regards to all aspects of our finances.

One topic that has many families scrambling to understand is life insurance.

For those that have it, they may be concerned that COVID-19 will affect their life insurance benefits. Those that don't have it fear that it may be too late.

Let's take a look and see what options do you have regarding securing a life insurance policy during the pandemic.

Who Needs Life Insurance?

Pretty much everyone should have some form of life insurance. Life insurance is needed if you have loved ones that depend on you for financial protection. This could be a spouse, kids or any other dependents that look to you as being their sole provider.

If something were to happen to you, the proceeds from your life insurance policy can be used by your dependents however they choose, which is typically to take care of any outstanding debts, such as a mortgage, and also alleviate some of the stress of the day-to-day expenses.

How Much Does Life Insurance Cost?

The cost of life insurance varies on several factors, including your age, your health, and how much life insurance coverage that you are seeking.

Another contributing factor is the life insurance company that you choose to purchase your policy through. Different life insurance companies will cost more or less, depending on the factors previously listed. It’s also important to know the financial health of the insurance company you’re choosing which can be found through A.M. Best.

How Has COVID-19 Affected Life Insurance?

As of now, there hasn't been any evidence of life insurance companies pulling out of the market.

Researchers recently analyzed over 800,000 life insurance policies from 100 companies and confirmed this. So, if you're still seeking to purchase life insurance, there are still many options readily available.

There also hasn't any reports of life insurance companies not paying out if there has been a death due to a COVID-related claim.

What has changed is that the application process, which is often referred to as underwriting, is taking a lot longer, depending on the health factors the person is seeking coverage.

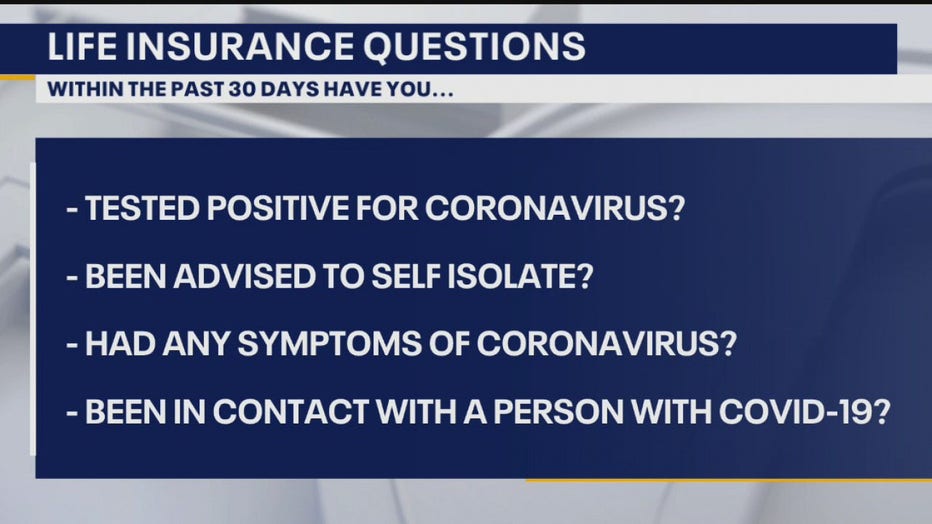

The biggest change in life insurance from coronavirus is that most insurance companies have changed their health questionnaire to include questions about the recent pandemic. The questions you'll need to answer will be within the last 30 days:

- Have you tested positive for coronavirus?

- Had any symptoms of coronavirus?

- Been advised to self quarantine?

- Been in direct contact with anyone who has been diagnosed or who is suspected of contracting COVID-19?

If you answer yes to any of these questions, the most likely result is your policy being postponed.

Postponed does not mean that you are being denied coverage, but it could mean that it could take months before you get a final decision.

If you contracted the coronavirus and were hospitalized due to complications of the virus, then your application could be postponed much longer than someone who was advised to self-quarantine.

What Happens If I Have A Pre-Existing Condition?

If you have any pre-existing condition, this will not prevent you from getting life insurance coverage, but it would also depend on how severe your condition is. If an insurance company deems you as being high-risk, then you may be flat-out denied without any other consideration or opportunity to get coverage.

If you have a condition that puts you at higher risk from COVID-19, this is where an insurance company may postpone the policy until they can get more information about the severity of your condition.

Health issues, such as asthma, diabetes, heart disease, especially if you're over the age of 50, will now make it much more difficult to get coverage.

The takeaway: While the situation regarding life insurance coverage has changed due to the pandemic, this doesn't mean that you should dismiss the importance of getting coverage. Working with an independent life insurance agent that is able to shop around with several different companies and is knowledgeable in high-risk conditions is your best bet.

Jeff Rose is a combat veteran, certified financial planner and founder of GoodFinancialCents.com