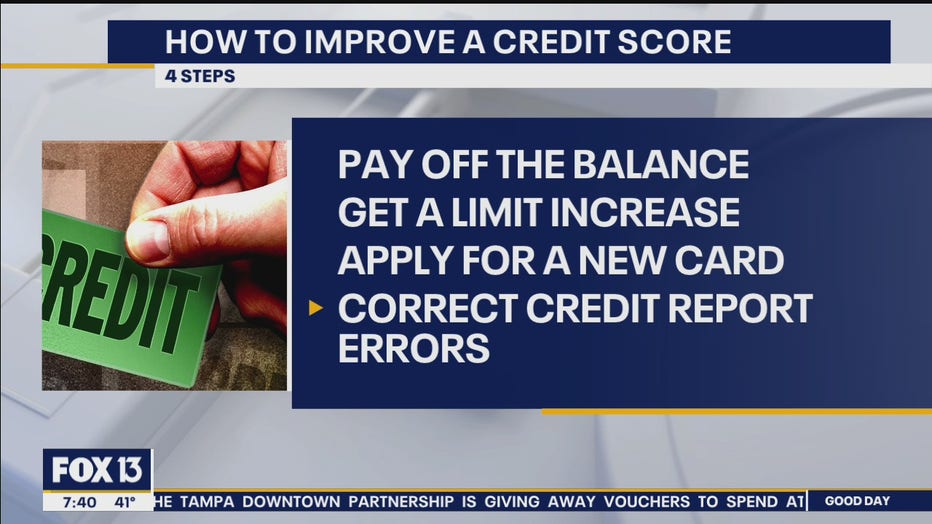

Here are four ways to improve your credit score before 2021

How to improve your credit score

Improving your credit score may be easier than you think. Financial expert Jeff Rose explains four ways to help accomplish the goal.

TAMPA, Fla. - 2020 is a year that many of us want to put in the memory books, and 2021 can't get here soon enough.

Chances are, one of the last things you've worried about is your credit score. But if you are wanting to make 2021 much better, then your credit score is something you want to be aware of and hopefully approve.

Your credit score is your financial lifeline and the only thing that financial institutions and potential lenders have to go off of. Having a good credit score can help you save money by lowering interest rates on loans, credit cards, and even your car insurance. It can also be the difference whether you get approved or rejected if you want to rent a new place.

Here are four ways that you can improve your credit score before the year ends:

1. Pay off your credit card debt.

One of the most determining factors of your credit score is how much of your available credit you are using. This is measured by what credit bureaus refer to as the credit utilization ratio. Essentially, this ratio measures how much of your available credit you are using.

For example, if you have a $10,000 limit on your credit card and you have charged $5,000, your credit utilization ratio would be 50%. A common ratio that many financial experts suggest not to surpass is 30%. Anything more than that is said to hurt your credit score.

Recently, Can Arkali, principal scientist of analytics and scores development at FICO, reported that there is nothing significant about a 30% revolving utilization. It's relative. In FICO's research, they show that the highest-scoring 25% of all consumers, those with a score above 795, use an average of 7% of their credit limit.

In a nutshell, if your end goal is to improve your credit score, shoot for a credit utilization ratio lower than 30%.

2. Ask your credit card company for a credit limit increase.

Another easy way to increase your credit score without doing a ton of work is calling your credit card company and asking if they are willing to increase your limit.

Please note that this is not a ploy so that you can go on a spending spree for the holidays. The goal here is to improve your credit utilization ratio by decreasing how much of your available credit you're using.

3. Apply for a new credit card…but there's a catch.

If you tried requesting a credit limit but got denied, another option is to apply for a brand-new card altogether. But the same rules apply with increasing your credit limit. You will not be using your new card, no matter how tempting or shiny it is.

Your credit utilization ratio plays a significant role in what your credit score is. If you apply and get approved for a new card but rack up more debt, then this would cause more harm than good.

4. Fix your errors.

In addition to your credit utilization ratio, one of the other big factors in determining your credit score is how accurate your credit report is. The FTC recently released a study that showed, on average, 1 in 5 consumers has an error on their credit report.

Of those, 25% of them had an error that was substantial, meaning that it was costing them more money by having to pay more interest, or it was preventing them from getting approved for certain loans. That's why it's so important to see if you have any errors.

It's important to mention that most of the errors found on your credit report are actually not your fault. Most of the errors come from the credit bureaus or previous companies that you've worked within the past.

Common errors could include basic personal information (such as name or address), mistaken financial accounts, or accounting reporting errors. Either way, an error is simple to fix but does require a little bit of work.

If you do find an error, you'll need to report that error to the credit bureaus, notifying them what needs to be corrected. But you can only do this if you request and check your credit report and examine it for errors.

You can get your credit report from the three reporting bureaus, such as Experian, Equifax, and TransUnion. You can also go to annualcreditreport.com and request a free credit report.

It's time to make 2021 a better year. And one of the easy ways you can do that is improving your credit score by considering these four simple steps.

Jeff Rose is a combat veteran, certified financial planner and founder of GoodFinancialCents.com