'We can’t rebuild': Ruskin family stuck after hurricanes and insurance chaos

RUSKIN, Fla. - Nine months after Hurricanes Helene and Milton battered Florida, families like the Kvockas are still displaced. Neil and Nicholle Kvocka bought more than $1 million in property insurance for their waterfront home—yet they’re living in a camper with their two teenagers.

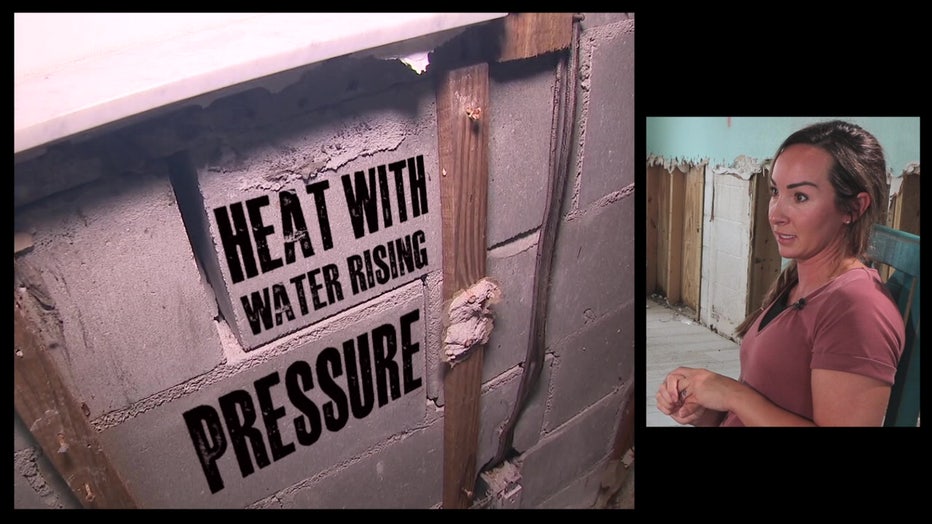

The storm surge from Hurricane Helene flooded their home. A fire, sparked by damage to a neighbor’s house, spread to their roof. The Kvockas say engineers later found rooms in the home were physically shifting—yet the Kvockas still can’t get the insurance payout they need to rebuild.

"We were like, at least we have good insurance. Who would have thought?" Nicholle said.

Insurance Blame Game

The Kvockas say they were caught between two insurers passing blame.

- Citizens Insurance (state-run) denied claims related to flooding, as Citizens is not responsible for flood damage.

- Federal flood insurance said some of the damage was due to wind or fire damage which it does not cover.

Citizens paid nothing. Flood insurance paid $104,000—not nearly enough to rebuild the home based on assessments the Kcovkas received from contractors. They say contractors told them the home needs to be torn down and rebuilt.

"There’s more damage than it’s worth. It’s not fixable." – Nicholle Kvocka

Arbitration Offered a Glimmer—Then Crashed

Just before a scheduled arbitration hearing with Citizens, the Kvockas were offered a last-minute settlement:

- Initial offer: $41,000

- Increased to: $250,000

They declined—because they said it was still far short of rebuilding costs.

The Kvockas then lost in arbitration.

"It’s mind-blowing," said Nicholle.

Multiple Storms, One Big Mess

The timeline made things worse. Hurricane Milton struck just 13 days after Helene, leading to:

- 3 claims

- 2 hurricanes

- 2 insurers

- 1 total payout: $104,000

That payout is now frozen by their mortgage company, pending resolution.

FOX 13's Craig Patrick asked the Kvockas why they don't just sell.

Nicholle responded, "Our neighbors are selling for less than we owe. We can’t afford to rebuild."

From Dream Home to Camper Life

Before the storms, their home was valued at $1.3 million. Now, real estate models put it closer to $400,000.

The family of four now lives in a $105,000 camper.

- Their 16-year-old sleeps in one loft.

- Their 14-year-old in the other.

- They still owe nearly $100,000 on the camper loan.

- Their mortgage is in forbearance.

- They continue to pay for home insurance on a house they can't live in.

"They don’t pay out. And if they do, it’s nickels and dimes for something we paid top dollar for," said Neil.

READ: Artificial intelligence to help growers assess hurricane crop damage

What's next:

We took their story to Florida’s Insurance Commissioner, who said:

- His office may intervene in this case.

- He supports a single-adjuster system—requiring all insurance providers to send one shared adjuster for fire, flood, and wind damage.

That fix would require action from state lawmakers.

The Source: Information for this report came from state records, an interview with Florida Insurance Commissioner Michael Yaworsky, and information provided by the Kvockas.