Bill that would require Citizens Insurance to expand windstorm coverage to all Floridians stirs debate

Push to expand Citizens Insurance to all Floridians

FOX 13's Kellie Cowan takes a look at a bill in Tallahassee that would expand wind coverage through Citizens Property Insurance to all property owners in Florida, and why not everyone is onboard with it.

TAMPA, Fla. - Florida lawmakers will soon consider a bipartisan bill that would expand windstorm coverage through Citizens Property Insurance to all property owners statewide, but the proposal is not without its critics.

House Bill 13

The measure, filed by State Rep. Hillary Cassel, would make every Florida homeowner eligible to buy Citizens coverage specifically for wind damage.

What they're saying:

Lawmakers who support the bill say it would allow everyone to tap into Citizens’ lower rates, arguing that Citizens would be better suited to build a surplus to handle major storms, hereby lowering the chance for an assessment on all taxpayers.

"Under our plan, Citizens would become the insurer of first resort for Florida homeowners seeking wind coverage," State Rep. Spencer Roach (R-Lee County) told members of a House committee earlier this month.

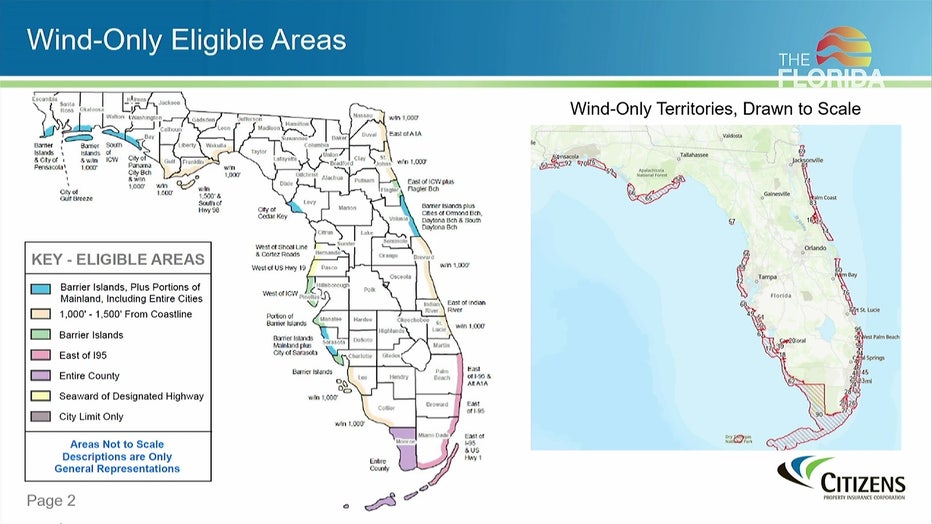

Currently, Citizens’ wind-only coverage plans are only available in select coastal regions of Florida.

"What our plan proposes is that Citizens actually has the ability to spread that risk out throughout the state into those places that are cherry-picked right now, currently by carriers that are coming in and taking out policies and only taking out the best, least risk policies possible. At the end of the day, Florida is still on the hook for the biggest policies and the biggest risk," Cassel said.

READ: Florida regulators approve new rates for Citizens with changes taking effect June 1

Mark Friedlander of the Insurance Information Institute says he’s baffled by the bill.

"In order for Florida to continue to sustain its stability from the last crisis and get to a much healthier market position you can't have citizens grow again," said Friedlander, who has supported austerity measures aimed at reducing the number of policyholders for the state-backed insurer of last resort.

"We need to continue to see Citizens shrink through depopulation. Any ideas to grow the number of policies for citizens is asking for trouble and it will lead to a next risk crisis here in Florida."

Friedlander and Citizens’ own CEO Tim Cerio warn the plan would put Florida on the fast track to an even greater insurance crisis, potentially allowing the policy count to swell beyond 10 million and leaving all taxpayers on the hook for bailouts.

The Florida Legislature has enacted several depopulation measures in recent years to try to lower the number of Citizens policyholders. In November, Citizens Property Insurance Corp. announced it had reduced its count to fewer than one million, down from a high of 1.4 million policyholders in September 2023.

PREVIOUS: Citizens starts year with 935K policies

Friedlander says an actuarily sound policy count would be in the 400,000-500,000 range.

"Citizens is clearly heading in the right direction. Depopulation has been extremely successful. Every month we're seeing new plans in place for more private insurers to get involved to take out policies because private insurers are much healthier financially. They have risk capacity," explained Friedlander. "It's proving it is working. The legislative reforms have led to this."

The proof, according to Friedlander, are new private companies entering the market and a leveling off in insurance rate hikes.

"Data shows that Florida insurers had the lowest average rate increases filed with state regulators in the country last year, a 1% average. We saw 33 states last year with double-digit average rate filings and five states over 20%," noted Friedlander.

READ: Florida regulators approve new rates for Citizens with changes taking effect June 1

According to Insurance Information Institute data, the average premium in Florida increased by $100 last year, a sign of a stabilizing market.

"We don't see any reason to have a dramatic change in state regulations that could totally blow up the market and turn into the next Florida risk crisis," said Friedlander.

In a presentation before the House Insurance and Billing Subcommittee last week, Roach said Florida could learn from similar state-backed models in California and Texas.

"We've got 50 years of empirical data from Texas and about 30 years of empirical data from the state of California. Texas has been doing this since 1971. They still don't have a state income tax. They're still financially solvent," said Roach.

CLICK HERE:>>> Follow FOX 13 on YouTube

According to Friedlander, though, California’s FAIR plan and the Texas Windstorm Insurance Association should serve as warnings for Florida lawmakers.

This week, California announced a $1 billion bailout for the FAIR Plan, after the not-for-profit insurer ran out of money to cover the claims for last month’s devastating wildfires. Friedlander warns it’s just the tip of the iceberg for Californians.

"I just talked to the head of the one of the federations of California that represents insurers. And they are fairly confident there are going to be multiple assessments," said Friedlander. "What the Texas plan has done, is had to ask for several rate increases because it has been stretched pretty thin when it comes to landfalling hurricanes in Texas. Most recently, Hurricane Beryl had a big impact on the Texas plan. So these are two really bad models."

Currently, a companion bill has not been introduced in the Florida Senate. Friedlander says he takes that as a sign lawmakers there are not taking the universal wind proposal seriously.

What's next:

The Florida Legislature begins its annual session on March 4.

The Source: Information for this story was gathered by FOX 13's Kellie Cowan.

STAY CONNECTED WITH FOX 13 TAMPA:

- Download the FOX Local app for your smart TV

- Download FOX Local mobile app: Apple | Android

- Download the FOX 13 News app for breaking news alerts, latest headlines

- Download the SkyTower Radar app

- Sign up for FOX 13’s daily newsletter