Economist: Florida's craft beer industry is faring better than expected, so far

This St. Pete brewery opened on the day that everything closed

A Bay Area business that clawed its way through the pandemic comes out the other side. Charley Belcher stopped by Bayboro Brewing in St. Petersburg, where they just celebrated a special milestone.

TAMPA, Fla. - It appears Floridians love their local craft beer. It is one of many reasons why the industry as a whole seems to be holding steady more than one year after the COVID-19 pandemic began. That doesn't mean there haven't been financial struggles, stress, or shuttered breweries, but, so far, experts say it is better than anticipated.

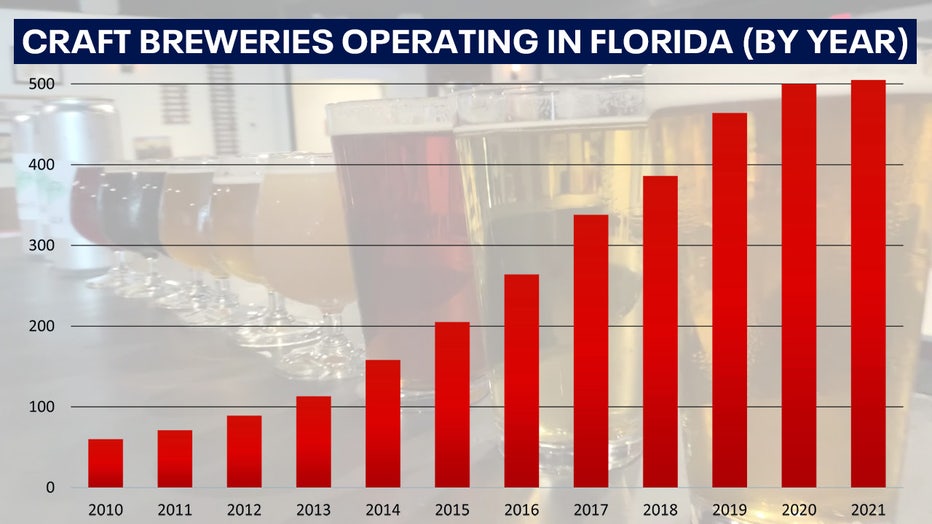

In the last decade, the number of craft breweries in the Sunshine State exploded -- from Sarasota to Lakeland, and Miami to St. Augustine.

Before March 17, 2020, Florida's craft beer lovers had plenty of options to venture outside their home, stop at their local brewery, and enjoy a cold pint.

Tampa Bay itself has a plethora of breweries, like the experimental sours of Hidden Springs Ale Works in Tampa or the "Straight Outta Lakeland" IPA at Swan Brewing. Customers could even sit back and play Mario Kart against their friends with a cold beer within arm's reach at Right Around the Corner Arcade Brewery in St. Petersburg.

But with COVID, the world turned upside down and customers couldn't pour into their favorite breweries. Floridians were still able to order their favorite craft beer, but it had to be picked up in a crowler or growler, and consumed at home.

Calusa Brewing in Sarasota was ready to reopen its doors in 2020 September after -- like other breweries -- they were forced to close twice in 2020 at the state's direction and quickly switch to to-go sales during the summer. (FOX 13 / file)

For Florida, the average number of closings has been much lower than the national trend. For every five Florida brewery openings in 2020, one brewery closed. Nationally, for every two brewery openings, one brewery closed.

There are several factors that impacted the craft brewery industry, depending on the state or region. Lifting lockdowns, allowing outdoor and indoor seating earlier than other states, and Florida’s weather conditions are just a few contributing factors that helped the industry in the Sunshine State.

RELATED: This St. Pete craft brewery opened on the day everything closed

Nationally, about 4% of the breweries in the country closed in 2020 -- which can be a pint half-full or half-empty perspective, considering how suddenly businesses had to shut down and adjust, according to the Brewer's Association (BA), which has been keeping track of U.S. craft brewery trends since the 1980s.

The statistics appear to be on par with a national trend that was already taking place before the pandemic.

The BA said it's also important to keep in mind that the ripple effects of the pandemic won't be entirely known until later this year when brewers can determine if they can make ends meet. Also, the closures could be due to several reasons, not just the pandemic.

How can we measure the pandemic's impact on the craft brewing industry?

Before the pandemic hit, there was already a decline in the number of craft brewery openings in the U.S. Factors include competitiveness among breweries and the maturity of the brewery market.

When tracking the number of openings and closings, there could be some discrepancies. As of March, there are 505 breweries with permits in Florida, according to the Alcohol and Tobacco Tax and Trade Bureau. A breakdown on the number of breweries by state can be found here.

Some of these include "breweries in planning," which means they have yet to open to the public for the first time. Sometimes, there is a two-year lag in data between first getting a permit and actually opening, as well as recently-closed breweries, according to Bart Watson, the chief economist at BA.

According to the association's latest data, there are 386 active Florida craft breweries. Watson said the organization tries to track all active breweries, regardless of whether they are a member.

If you can drink it, Magnanimous Brewing will brew it

Coffee and beer are two things people love to brew. It's also the concept behind a new Florida Avenue taproom called Magnanimous.

READ: From lattes to lagers, pandemic-born brewery always has cold ones on tap

Even further, not all U.S. breweries chose to reopen their doors during the pandemic. Hundreds are still "hibernating."

"In our tracking, we don’t count those breweries as closed. They still hold a license," Watson explained. "Many of them are still selling beer to-go, but they haven’t fully reopened. Some of them may just decide that the cost of reopening is too great and move to close in 2021."

One such example is Inoculum Ale Works in downtown St. Pete. State records show the all-sour brewery still has an active license, however, locals have noticed its 1st Avenue North location hasn't exactly been open for over a year. Back in February, Inoculum said the brand still exists, and they may begin selling packaged beer within the next few months.

"I think 2021 is going to make a lot of these numbers clearer in context," Watson said, "because 2020 isn’t an isolated incident…breweries took on a lot of costs."

Nationwide, craft breweries saw a 9% decline in craft beer volume sales, as well as production, which is the first drop the organization has seen since it began tracking statistics in the 1980s.

"The reason for the decline is largely the decline in draft sales," Watson said. "With the decline in draft sales, brewers were selling less and thus producing less."

Pre-pandemic, Inoculum Ale Works used an old-school projector to display its sour-only tap list. (FOX 13/File)

What do the numbers say about Florida?

Craft breweries in Florida were forced to close their doors in 2020 -- not once, but twice. At one point, hundreds of Florida breweries and craft-beer supporters shared a letter across social media begging Governor Ron DeSantis to work with them and allow on-site consumption to resume.

The letter, which was shared in July 2020, warned that more than 100 breweries could permanently close "if this continues for more than 2 weeks...and with that, nearly a third of the 10,000 jobs supported by our industry."

It wouldn't be until September that DeSantis allowed breweries to reopen, and then only with capacity limits.

In the days leading up to when the pandemic was declared, Gulfport Brewery + Eatery was gearing up to open for the first time. On June 27, it officially opened and was able to operate at 50% capacity since it had the appropriate a food license.

PREVIOUS COVERAGE: Florida bars cook up ways to reopen despite ongoing COVID-19 shutdown

Watson said there are three factors that caused the decrease across the country. While one is obviously the pandemic, the other two are longer-term trends and maturation of the the market.

"I think Florida is probably going to feel this a little bit less than parts of the country, like Colorado and Oregon, that have much higher brewery-per-capita numbers," he explained. "We’re starting to see a slowdown in openings. For example, between 2018 and 2019, openings were down by about 15%."

"So, a chunk of it is COVID and certainly breweries either delayed or chose not to open," he added, "but a chunk of it is that in a more mature market, you’re going to see fewer openings."

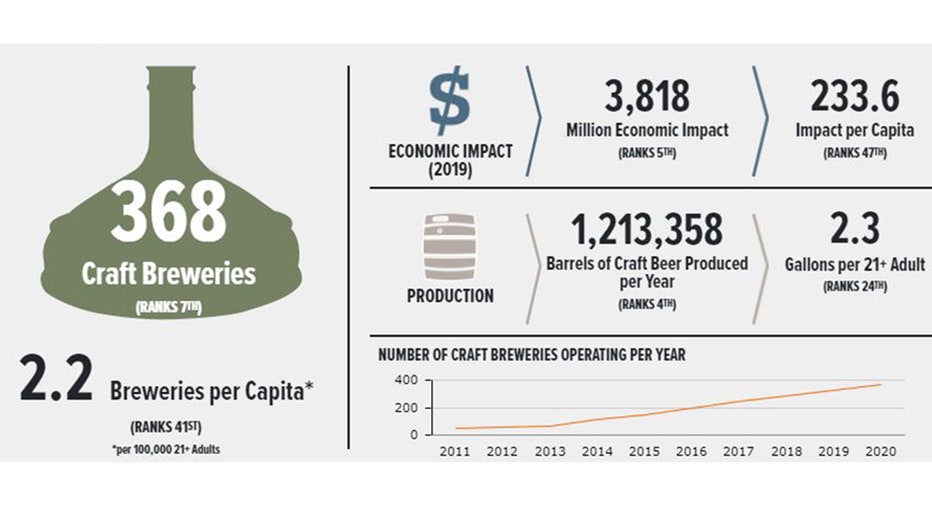

The Brewer's Association's data for Florida as of 2020. (Courtesy: BA)

Florida currently stands at 2.2 breweries per capita. In 2019, the BA found that 47 breweries opened in Florida and nine closed. In 2020, 40 breweries opened and eight closed.

By comparison, Oregon has 9.6 breweries per capita. The West Coast state saw 23 breweries open in 2019 and 16 breweries close. In 2020, 13 opened and and 14 closed.

Another state with a high number of breweries per capita is Washington. In 2019, 34 breweries opened and 24 closed. Whereas in 2020, 29 opened and 17 closed.

Breweries and ‘breweries in planning’ through March of 2021. Source: U.S. Department of the Treasury.

The association identified the following Florida breweries that closed last year:

- Mad Robot Brewing Company in Boca Raton

- Something’s Brewing in Winter Park

- Atlantic Beach Brewing Company in Atlantic Beach

- Big Blue Brewing in Cape Coral

- Lost Shirt Brewing Company in Melbourne

- Quarters Brewing Company in Melbourne

- Concrete Beach Brewery in Miami

- Old Soul Brewing in Fort Myers

Not included on the list of closures is Four Stacks Brewing Company in Hillsborough County. Its Riverview location closed last summer, but the BA didn't consider it as a full closure since the brewing did not take place there; it was purely a retail location.

The primary Four Stacks location in Apollo Beach remains open, but earlier this year, it almost shuttered. The community rallied to save it. It's the only brewery in that area.

Apollo Beach community saves Four Stacks Brewing

After its Riverview location closed, the Four Stacks Brewing Company in Apollo Beach was a close second – but locals weren’t going to let that happen.

What do the numbers say about the Southeast U.S.?

When looking at different regions of the U.S., one of the areas that weathered the storm collectively was the Southeast, Watson said.

"I don’t want to be overly broad and say, 'Southern states did better,' but generally, the South and Southeast had stronger numbers than the national trends, at least in terms of brewery production," he said. "One caveat there is that that has been a region that has been developing and growing faster."

"That isn’t fully apples to apples in the more developed brewery environments in the West Coast versus the South, but we did see better numbers in parts of the Southeast," he added.

The region's positive trends appear to be for three reasons: market growth, consumer demand and the state government's reopening plans.

"I think those markets were maybe growing a little bit faster for some of the reasons we already talked about," the economist said. "They were a little bit less developed and had a little bit more room for growth."

September 2020: Governor says state is closer to reopening bars

During a visit to Green Bench Brewing Company, bar and brewery owners said they are starting to see consumer confidence building and want to move forward, but the past few months have been rough.

PREVIOUS COVERAGE: 'Time to move forward': Pinellas bar, brewery owners meet with Florida governor to discuss challenges

It appeared consumers in the Southeast were more willing to leave their homes to head to bars and restaurants.

"We saw them fully reopen – Florida is a good example of this – before a lot of the country. That in it of itself wouldn’t be the only reason," he said. "You would need the consumer piece as well. You can’t open if people aren’t going to come back out. I think, in general, we saw in the Southeast more openness to keeping these businesses open and consumers more willing to stay out and about."

Weather patterns also played a role. For the Sunshine State, it was a benefit. January and February are considered to be "good beer-selling times," where as the middle of the summer, the sales are not as high as the rest of the country.

"Florida does have a very different seasonality than the rest of the U.S. in terms of its beer sales," Watson said. "It peaks in the time of the year when everybody else is the slowest. That might have something to do with it as well as the greater ability to stay outdoor all year."

The Brewer's Association conducted a survey during the late summer in 2020, asking brewers what percentage of their on-site sales were outdoors. Nationally, it was 70%.

"Obviously, Florida has a greater ability to keep that level high all year-round -- or maybe not in the dead of summer," Watson explained. "For much of the year, Florida can continue to use outdoor space whereas you don’t see a lot of breweries in Michigan in the middle of January utilizing outdoor space."

What do the numbers say about the U.S.?

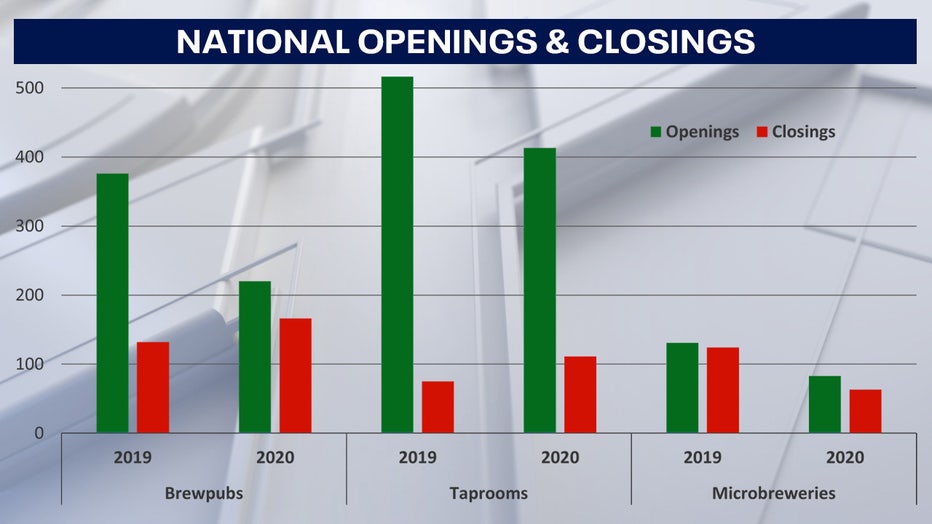

In total, there were 716 openings and 346 closings across the country. According to the BA, there were still more openings than closings across the country last year, which is a positive:

Brewpubs

- 2019: 376 openings, 132 closings

- 2020: 220 openings, 166 closings

Taprooms: Breweries that sell more than 25% of their volume on-site

- 2019: 516 openings, 75 closings

- 2020: 413 openings, 111 closings

Micro-breweries: Breweries that sell less than 25% of their volume on-site

- 2019: 131 openings, 124 closings

- 2020: 83 openings, 63 closings

Source: Brewer's Association

Slightly less than 4% of U.S. craft breweries closed in 2020, which is a much lower closing rate than some other hospitality industries, Watson said. Part of that is breweries' quick capability to sell to-go beers, which isn't as feasible as other small hospitality businesses.

However, that didn't mean that breweries didn't suffer any financial stress from it.

"Many small brewers took on lots of new costs to do that," Watson explained. "That’s not to suggest that they are not in great financial health, but I think that’s the biggest difference. Small breweries took on a lot of extra cost to do that, but that manufacturing component helped them sell a lot more beer.

By the BA's measurements, brewery jobs declined by 14% to about 138,371. The number of jobs was slightly above 160,000 in 2019.

"Hopefully those will bounce back," Watson said. "That is a similar decline from what we’ve seen in the Bureau of Labor Statistics. Based on member feedback and other discussions, a lot of those are the service jobs in the taprooms or the brewpubs that went away as sales decline and those breweries saw less traffic, but we are very hopeful to bounce back in 2020."

March 2020: Breweries making hand sanitizer instead of beer

Beers taps are going dry at some breweries across the country and the service industry has been dealt a possibly devastating blow from the COVID-19 pandemic. Since all bars in the state of Florida are closed, bartenders, DJs, and bouncers are out of a job for the foreseeable future.

One hurdle that all countries faced was the decline in tourism and travel. While the tourism economy is important in Florida, its development in the craft brewery industry, how the state government addressed reopenings, and consumer demand were all factors in helping the market during the pandemic.

"Probably the worst and weakest trends in the country this year and overall…were in Hawaii, for example, which really relies on tourism for its economy," Watson said.

In Hawaii, production was down 31% in 2020 and Alaska was down by 20%. Watson said the states had the weakest production numbers. However, that doesn't necessarily mean it could lead to closings.

In 2020, three breweries closed in Hawaii. There were no closings in 2019. One brewery opened in 2019, whereas three breweries opened in 2020.

"Keep in mind, there may be a lag between COVID trends and openings/closings," Watson said. "Breweries that opened in 2020 were in planning before COVID."

Tampa Bay Beer Week brings hope to brewers

Bay Area breweries like Cigar City are hopeful that the worst of the pandemic is behind them.

What's next?

The industry won't likely know the full impact of the pandemic until the fall. Watson said the organization is hopeful that craft brewery production will grow this year.

"2021 is going to be a year where, I think, we see craft make up some but not all of the volume that was lost in 2020," he predicted. "Then in 2022, returning to more of that previous trends. And then 2023 settling back into growth rates that we were seeing before."

The industry is not out of the woods yet. Sales could recover, but it all depends on if they recover quick enough this year.

"I think we’re going to have a really good sense of this by the end of summer, early fall," Watson said. "It’s going to be very interesting to watch."

For now, Florida has a ratio of 5:1 in terms of craft brewery openings and closings, whereas nationally, the ratio is closer to 2:1.

"That’s one we’ll watch this year and see," Watson said. "Does Florida’s number come back to more of that national average? Or does it stay strong suggesting that breweries indeed did make it through -- maybe not fully healthy -- but better than other parts of the country?"