Parents hope for answers about missing $250K after special needs trust fund company’s bankruptcy filing

ST. PETERSBURG, Fla. - The parents of a daughter with disabilities hopes to finally have some answers after claiming a quarter of a million dollars went missing from the same St. Petersburg special needs trust fund company that recently filed for bankruptcy, accusing its founder of mishandling funds.

In 2013, Richard and Kim Musczynski settled with a doctor and hospital in Palm Beach County after filing a lawsuit accusing them of misdiagnosing their daughter's condition when Kim was pregnant.

Their daughter, Abagayle, was born with a brain abnormality that caused her to develop cerebral palsy. She also suffered from severe seizures, was blind in one eye and unable to walk and talk.

READ: Special needs trust fund company files for bankruptcy, founder accused of taking $100M

She passed away in 2022 when she was just 11 years old.

"She was just absolutely beautiful in every which way and form," said Kim. "She just touched so many lives and she was just amazing. And we miss her so, so very much."

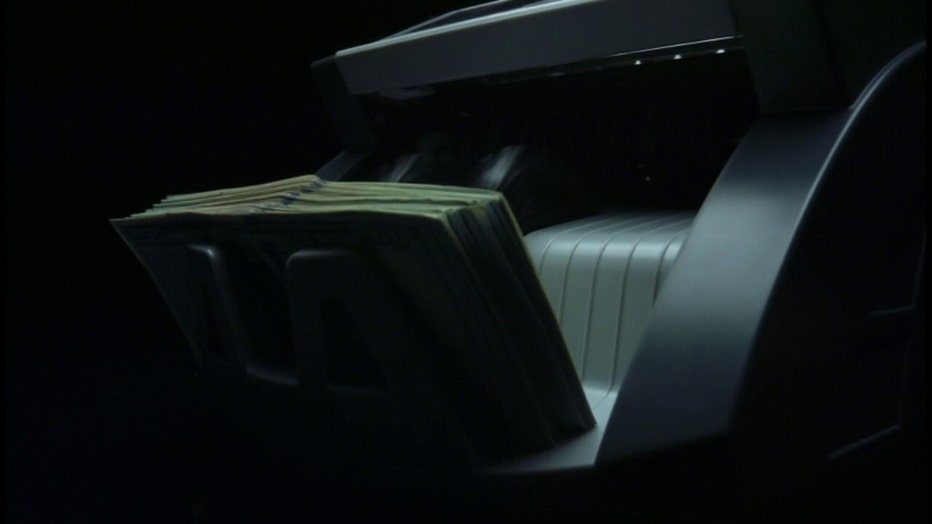

Richard and Kim wrote a check to the Center for Special Needs Trust Administration in St. Pete totaling more than $756,000. The Musczynski's said they began to feel uncomfortable with how the center was handling the funds.

Court records show Richard and Kim attempted to remove the money from the Center. The company, however, went to court to prevent them from doing so, even attempting to have the parents removed as guardians of their daughter's trust.

MORE: Florida man allegedly takes stolen Amazon van on 20-mile joyride: 'Is your package late?'

The Musczynski's said when they finally got a look at the financial records, they realized about $250,000 was missing.

"I was just completely heartbroken. I mean, to the point where I kind of knew someday, and I kind of hope that someday, you know, my concerns would be answered," Kim said.

The family believes they received some answers last week, when they saw the FOX 13 report about the center filing for bankruptcy, while accusing its founder, Leo Govoni, of issuing loans totaling $100 million to one of his companies, Boston Finance Group. In the bankruptcy filing, the center's new leadership claimed Govoni didn't receive official approval to issue the loans and never paid back the money.

A spokesperson for the center has said, as a result, the accounts of more than 1,000 of the Center's 2,000 clients have been partially or entirely drained.

"[The new leadership] are heartbroken over this and working nearly round the clock, no stone unturned, to figure out how we can get as much of those funds back where they belong as possible," Beth Leytham, a center spokesperson, told FOX 13 last week. "We will be looking not just at bankruptcy, but any and all legal remedies to do as much as we can."

READ: Sundial shopping center in downtown St. Pete to get makeover

Leytham told FOX 13 it's unclear whether the Musczynski's funds were impacted by the loans.

"I would just really hope and pray that there is some closure to this and that there is some justice," Kim said. "I feel it's really important for these families, not only for us, but for families around the country, that there's some form of justice for them and that, at some point, some day, they can figure all this out."

Govoni has deep business roots in Pinellas County, as the listed owner or manager of several companies. In federal filings, he's also listed as a financial backer and manager of Seaboard Craft Beer Holdings, which is the parent company of Big Storm Brewing.

Big Storm Brewing is owned by Govoni's son, LJ Govoni, who declined to comment Monday.

FOX 13's attempted to contact Govoni via text message, email and in-person on Monday, but he did not respond.

In a statement to FOX 13 last week, Govoni wrote:

"I dispute the allegations and characterizations in the filings of the Center as to the mishandling of any of the Center’s funds. I look forward to resolving this issue through the bankruptcy process or otherwise."